georgia property tax exemptions for veterans

To qualify for the exemption the veteran must own the property and must have a 100 Permanent and Total PT VA disability rating OR have been awarded Special Monthly Compensation by VA for 1 The loss or loss of use of one or more limbs or 2 Total blindness in one or both eyes. Also an unmarried surviving spouse of this Veteran or a Veteran receiving benefits for specially adapted housing under 38 USC 2101 may be eligible for a discount as well.

Principles For The Design Of The Real Property Tax Springerlink

6 State Benefits for Georgia Veterans Other Homestead Tax Exemptions There are a variety of homestead tax exemptions for Georgians who own their home and use it as their primary residence.

. These homestead tax exemptions include the following. For more information on tax exemptions visit dorgeorgiagov call 404-724-7000 contact your county tax commissioners office or consult a tax professional. Must be 65 years old as of January 1 of the application year.

This exemption applies to all ad valorem tax levies. In order to qualify you must be 65 years of age on or before January 1 and your annual net income cannot exceed 10000 for the immediately preceding tax year. Surviving spouses and surviving children may also be eligible for this property tax exemption.

Totally Disabled Code L12 Under Age 65You must be 100 disabled documented by two doctors letters or one doctors letter and Social Security award letter. Ad Access Tax Forms. Qualified veterans in Georgia may receive a property tax exemption for a primary residence of up to 50000 plus an additional amount which varies annually.

Property Tax Exemptions for Veterans. Veterans Exemption 100896 For tax year 2021 Citizen resident of Georgia spouse of a member of the armed forces of the US which member has been killed in any war or armed conflict in which the armed forces of the US. Includes 20000 off the assessed value on County 20000 off school and 20000 off recreation.

However it is restricted to certain types of very serious disabilities that are service-connected disabilities and proof of disability either from. Complete Edit or Print Tax Forms Instantly. Claimant and spouse income cannot exceed 10000 after deductions use line 15C of your Georgia tax return.

In 2022 the additional sum is 93356 according to Georgias Department of Veterans Service. State Senior Age 65 4000 10000 Income Limit This is a 4000 exemption in the state county bond and fire district tax categories. Up to 45000 in tax value may be excluded for service connected permanently disabled and honorably discharged Veterans.

If a member of the armed forces dies on duty their spouse can be granted a property tax. Columbus ga on monday april 18 2022 governor kemp joined by first lady marty kemp and local state and federal leaders signed the first military retirement income tax exemption in georgia history hb 1064. A property tax exemption is the elimination of some or all of the property taxes you owe.

A bill that expedites licenses for military spouses insuring they are issued within 90 days of applying hb 884. Representatives voted 161-0 for House Bill. Widowed un-remarried spouse of police officers and firefighters killed in the line of duty may be exempt from.

A property may be eligible for exemption in a few different ways including based on the existence of a homestead whether its used as a place of worship and whether its owned by a veteran. The Disabled Veterans Homestead Exemption is available to certain disabled veterans in an amount up to 50000 deducted from the 40 assessed value of the homestead property. For information in regard to the Exemptions listed below please call the Tax Assessors office at 770-288-7999 opt.

Download fax print or fill online Form ST-5 more subscribe now. Georgia disabled veteran benefits include an annual homestead property tax exemption of up to 60000 plus an additional sum set by the VA which is currently 90364. There are a variety of homestead tax exemptions available for all qualifying Georgia residents who own their homes and used them as their primary residence.

This makes the current total property tax exemption 150364 for Georgia disabled veterans. ATLANTA Georgia would exempt up to 35000 a year in military retirement income from state income tax under a bill passed Monday by the state House. Georgia Residents Homestead Tax Exemptions Georgia residents may be entitled to a homestead tax exemption whether they are veterans or not.

Property Taxes Calculating State Differences How To Pay

States With Property Tax Exemptions For Veterans R Veterans

Get Paid To Complete Offers At Treasuretrooper Com Offer Completed Paying

What Is A Homestead Exemption And How Does It Work Lendingtree

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Homeowners To See Higher Property Taxes Thanks To The Pandemic Here S What They Can Do Equitax

Do Military Veterans Get Property Tax Breaks In The U S Mansion Global

Veteran Tax Exemptions By State

Property Taxes By State In 2022 A Complete Rundown

Respect The Flags Respect The Flag Safety Topics Dig

Find Out If There Are Any States With No Property Tax In 2020 Which States Have The Lowest Property Taxes States Property Tax Property Real Estate Investor

Property Taxes By State In 2022 A Complete Rundown

I Also Have Friends Who Dont Have To Pay Property Tax After Getting Medical Disability Does Fox News Want This To Go Away R Military

Property Taxes Calculating State Differences How To Pay

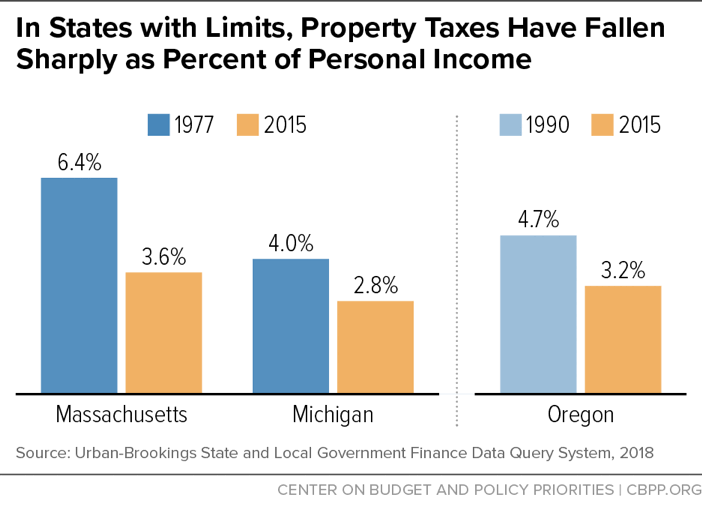

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Homeowners To See Higher Property Taxes Thanks To The Pandemic Here S What They Can Do Equitax

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans